ThreatFabric Investment Announcement

11 May 2023

Jump to

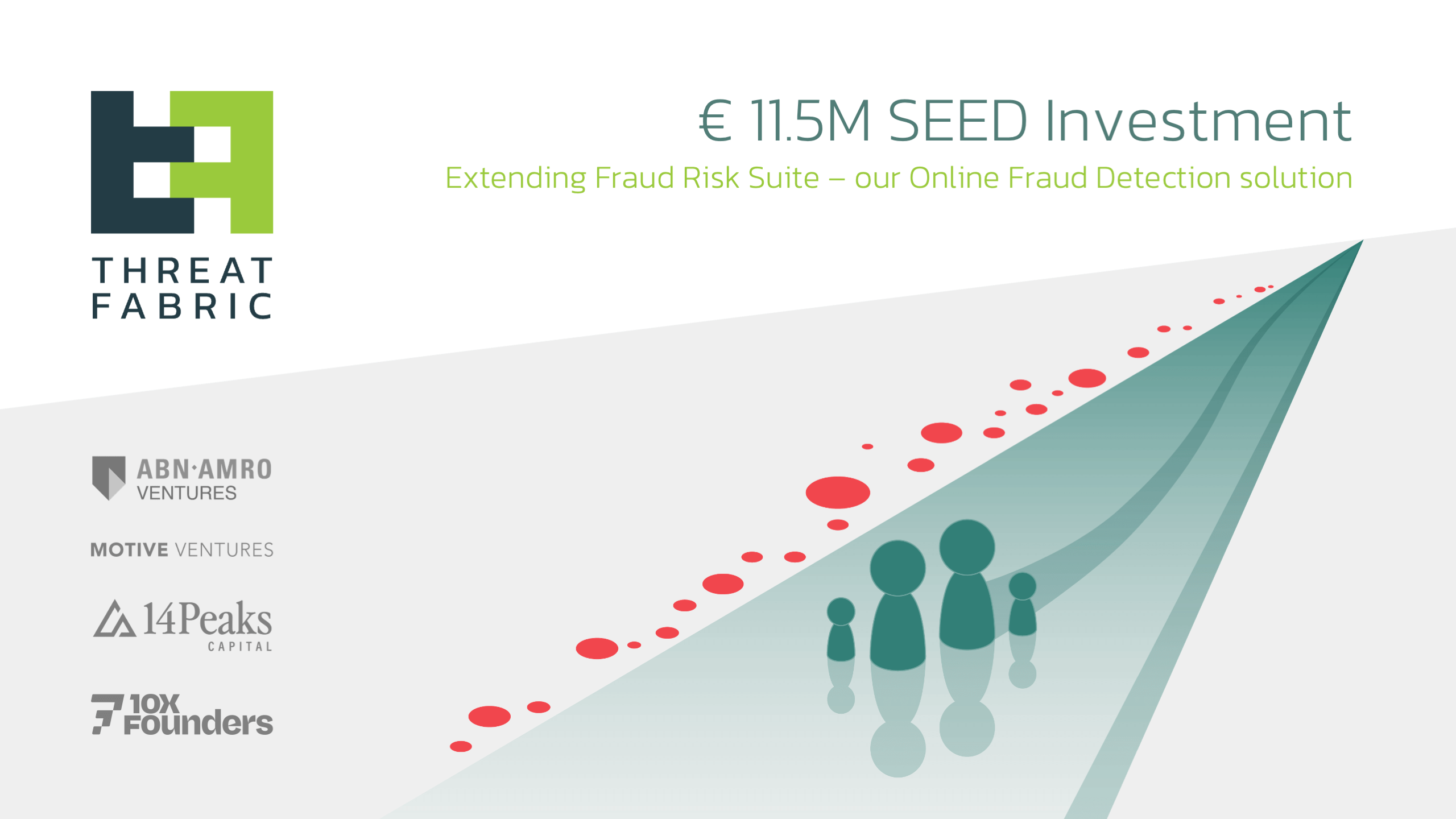

Amsterdam-based cyber fraud start-up closes €11.5 million Seed Round for its Online Fraud Detection Solution - Fraud Risk Suite.

Introduction

ThreatFabric, a leading provider of fraud detection solutions & intelligence for the financial services sector, has raised €11.5 million in a Seed Round to expand its technical capabilities and support the company’s growth. Specifically, to increase ThreatFabric’s international expansion and extend its fraud detection layers with behavioural based detection. This consists of the fraudster’s footprint with advanced AI models that include continuous threat modelling of attack paths inside online signup and payment journeys. The funding round was co-led by ABN AMRO Ventures, Motive Ventures and, with participation from 10xFounders and 14Peaks capital.

Truly helping banks protect their clients

The battle against online fraud has become a lot more complex with continuous data breaches and the availability of AI driven tools aiding syntactic IDs in the hands of fraudsters. This UK Finance report highlights the annual increase in online fraud numbers and reveals that fraud remains a significant threat to both individuals and businesses in the UK, with losses of £1.2 billion reported in the first half of 2022. This marks a 71% increase compared to the same period in 2021. Online fraud does not show any signs of slowing down, with the bank’s clients as the most vulnerable part of the chain. ThreatFabric’s software can positively contribute to this fraud epidemic by helping its clients – banks and financial institutions – protect their end-users from fraud and malware by using different protection layers, such as on-device malware detection and behavioural analytics.

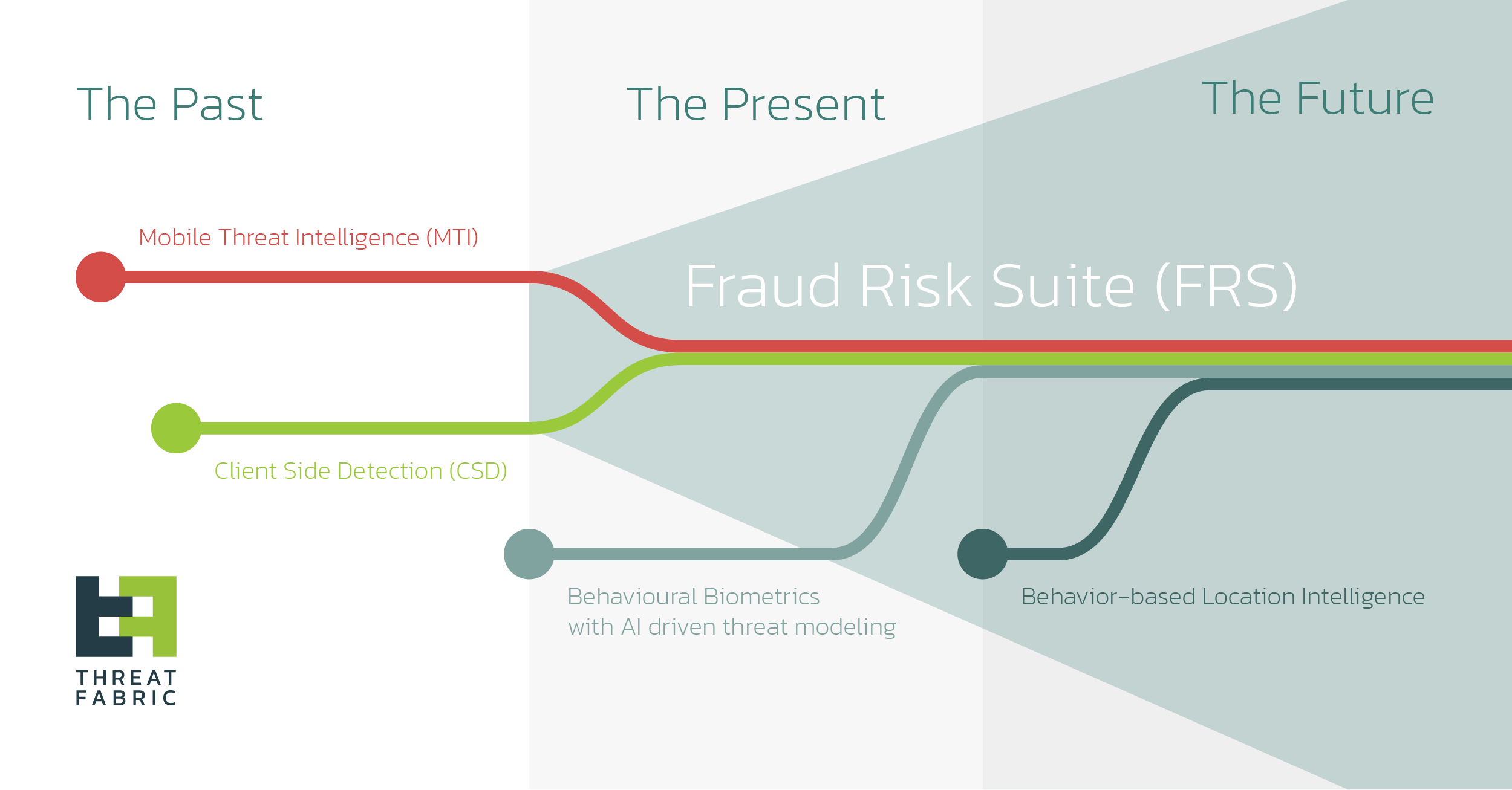

A large part of this investment will be used to extend two separate protection layers of ThreatFabric’s Fraud Risk Suite including behaviour-based location intelligence and behavioural biometrics by using advanced AI models that forecast potential fraudsters online footprint inside payment journeys. ThreatFabric’s strong background in fraud-based threat intelligence allows it to define attacks paths proactively through continuous threat modelling. For example, the strong need for drained savings, the use of new Remote Access Tools or call spoofing apps by fraudsters defines their core needs in Authorized Push Payment (APP) fraud.

This way ThreatFabric not only validates if the current user is genuine using behaviour biometrics based on mobile sensors or keystrokes, but also has indicators of very clear potential attack paths and the continuous changed footprint of fraudster tools inside any payment solution. Once a fraudster visits these attack paths or uses new attack tools, additional risk scores will be added to the overall behavioural analytics engine. Identifying the needs of a fraudster can be challenging due to their ability to disguise their intentions and manipulate their digital footprint. Behavioural Biometrics or Analytics as ThreatFabric refers to as their solution, includes continuous threat modelling on crucial parts of the payment journey of applications.

About ThreatFabric

ThreatFabric provides a software-as-a-service (SaaS) solution to the financial services sector, enabling banks and financial institutions to gain comprehensive fraud visibility across both web and mobile channels. The company was founded by Han Sahin and Yorick Koster, who have over two decades of experience in fighting cyber fraud. After their successful exit from Securify in 2011, they focused on extending their Fraud Risk Suite product, co-developed with ABN AMRO Bank, to create ThreatFabric. The company has grown rapidly since its inception in 2015 and now has a global presence with over 40 employees.

ThreatFabric was also recently named as a Sample Vendor in a Gartner Research Report entitled “Emerging Tech: Security — The Rise of Proactive Online Fraud Prevention” published on March 1st, 2023. The report highlights the importance of complementary multi-domain technologies and intelligence in improving fraud detection whilst urging Online Fraud Detection (OFD) providers to take full advantage of these critical technologies. ThreatFabric is committed to protecting all online payments against fraud to maintain trust in online payments and provide a frictionless, carefree experience for users.

Han Sahin, CEO at ThreatFabric, said in a statement:

“The ever-changing online fraud threat landscape can proactively be protected by including AI driven threat modelling in behavioural based defence layers. Fraudster also have a strong need which is strongly reflected in their digital footprint. This Seed Round with investment capital from ABN AMRO Ventures, Motive Ventures, and participation from 10xFounders and 14Peaks capital will be used for further expansion and to extend our Fraud Risk Suite platform focused on new proactive fraud controls. For example, with behaviour-based location intelligence and behavioural biometrics that use advanced AI models that forecast potential fraudsters online footprint inside payment journeys”.

About ABN AMRO Ventures

ABN AMRO Ventures is ABN AMRO’s corporate venture fund. It invests in technology companies that specialize in the digitalization of financial products, services and infrastructure. With EUR 150 million of assets under management, the fund has invested in over 20 companies including Quantexa, DFNS, Doconomy, Oper, Solaris, and Upvest. Previous investments include BehavioSec (exit 2022), Tink (exit 2021), OpenInvest (exit 2021), and Trifacta (exit 2022).

Hugo Bongers, Managing Director at ABN AMRO Ventures, said in a statement:

“The fraud issue is large and complex problem, that is only expected to get bigger in the future, as technologies like AI further develop. As a long-standing partner of ThreatFabric, ABN AMRO Bank has seen ThreatFabric’s profound understanding of the fraud issue and the high-quality solution the company offers. ABN AMRO Ventures is proud to support the co-founders Han and Yorick, and the entire ThreatFabric team in their next stage of growth and their mission to combat fraud and malware.”

About Motive Ventures

Motive Ventures is the early-stage investment arm of Motive Partners, focused on pre-seed through to Series A financial technology investments in North America and Europe. Motive Ventures is based in Berlin, London, and New York. Motive Partners is a specialist investment firm focusing on venture, growth equity and buyout investments in technology-enabled financial and business services companies. Motive Partners brings differentiated expertise, connectivity, and capabilities to create long-term value in financial technology companies. More information on Motive Partners can be found at www.motivepartners.com.

Michael Hock, Partner & Head of Portfolio Management at Motive Ventures, said in a statement:

“Best-in-class fraud detection technology is required to understand the ever-changing landscape of fraud vectors and threat actors in the digital financial services sector. ThreatFabric’s team impressed us with their deep domain expertise and their sticky product suite, which detects new and imminent threats tailored to digital banks and payments services. Unlike the plethora of point solutions in the cyber security market, ThreatFabric offers a comprehensive all-in-one platform approach, providing overall fraud visibility.”