Fraud Risk Suite

Peace of mind for you and your customers

We enable safe & frictionless online customer journeys by integrating industry-leading threat intel, behavioral analytics, advanced device fingerprinting and over 10.000 adaptive fraud indicators. This will give you and your customers peace of mind in an age of ever-changing fraud.

Benefits

The strong digital transformation and immense popularity of mobile banking has also increased threats and fraud. ThreatFabric can help you regain control and stay away from the never-ending cat & mouse game with fraudsters who disrupt your users’ lives and your business.

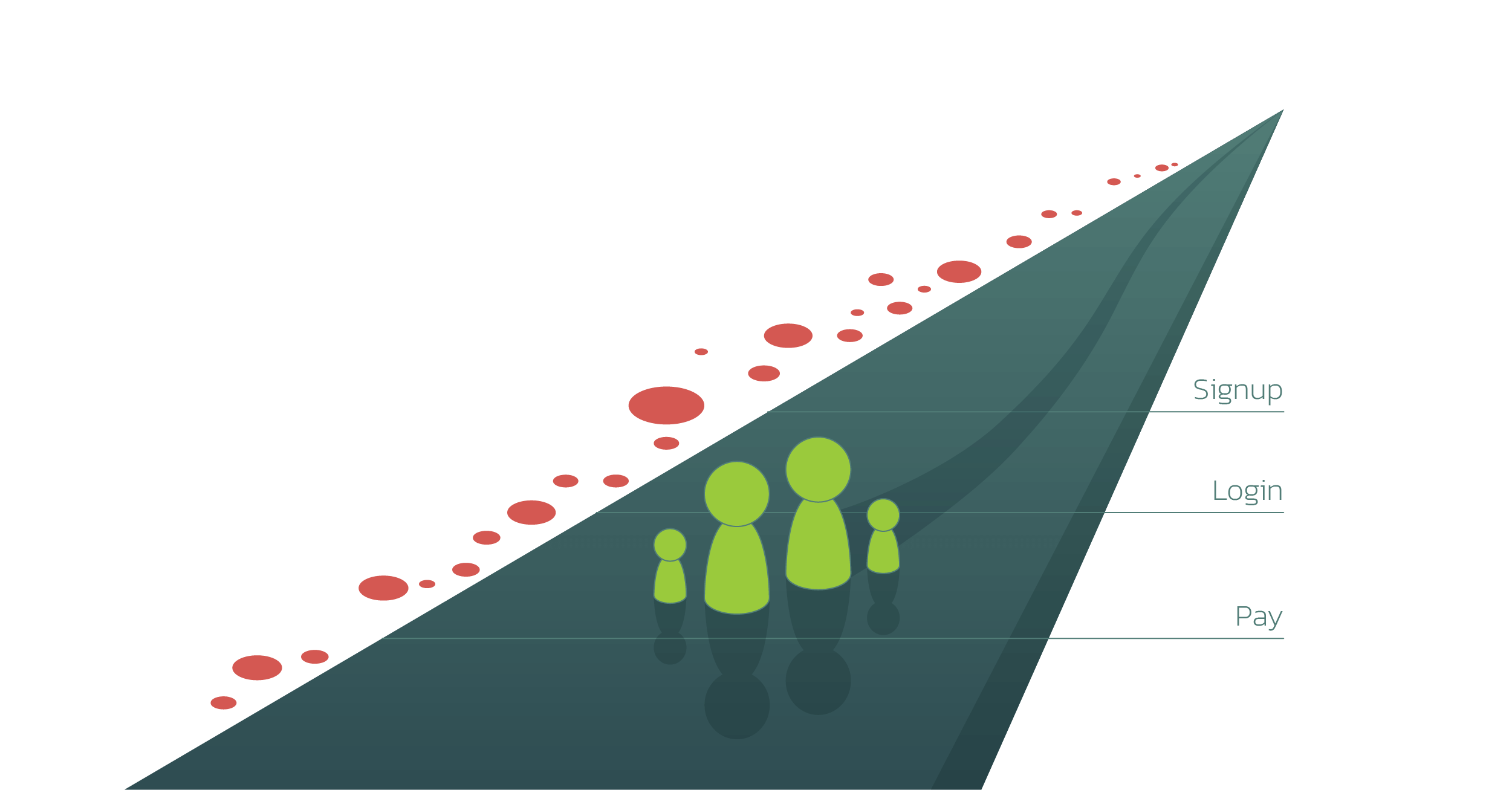

Fraud protection without friction or churn

Driven by industry leading threat intel

Layered fraud indicators to adapt to ever-changing fraud

Safeguarding millions of users and billions of transactions

Fraud

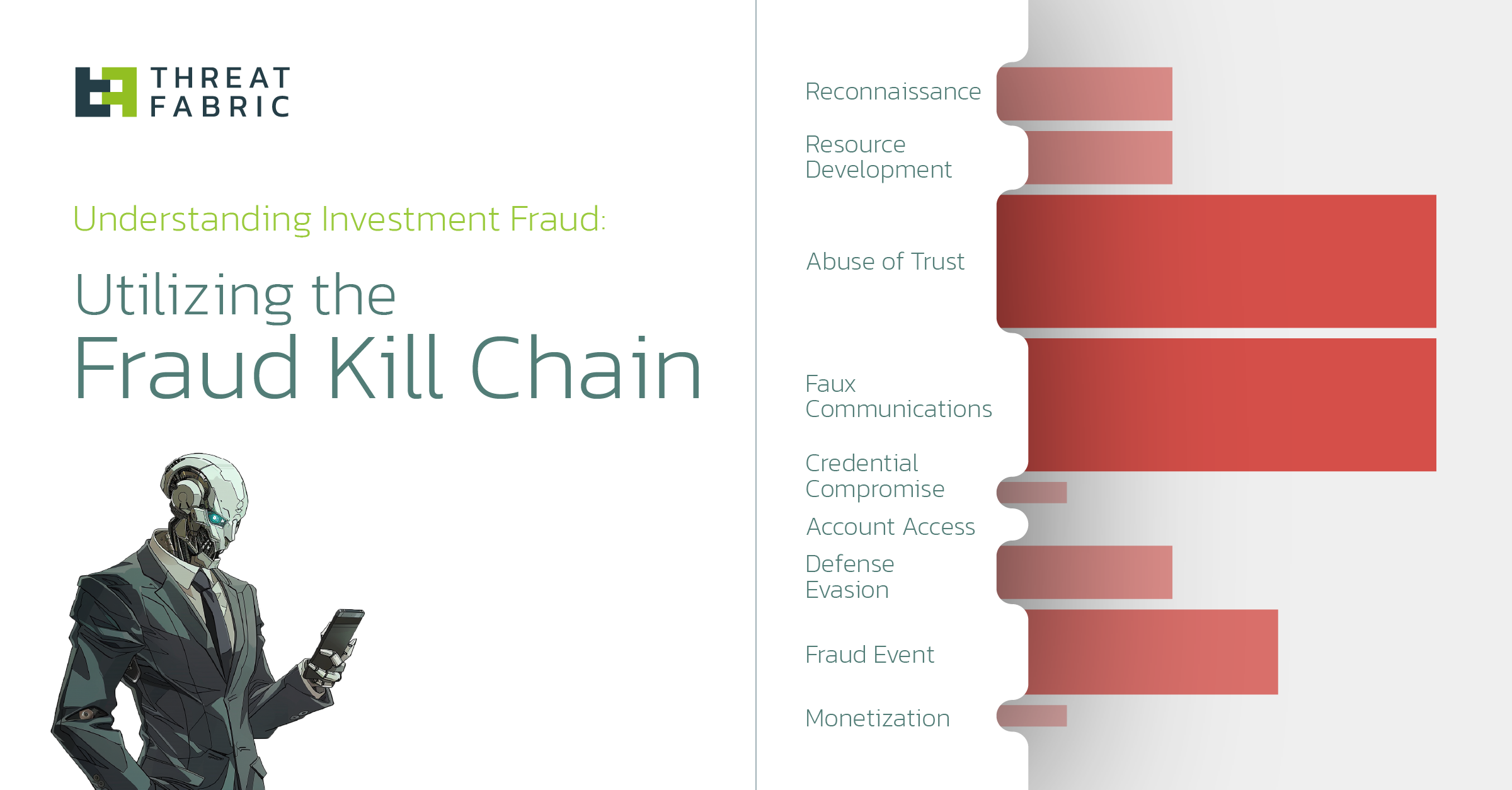

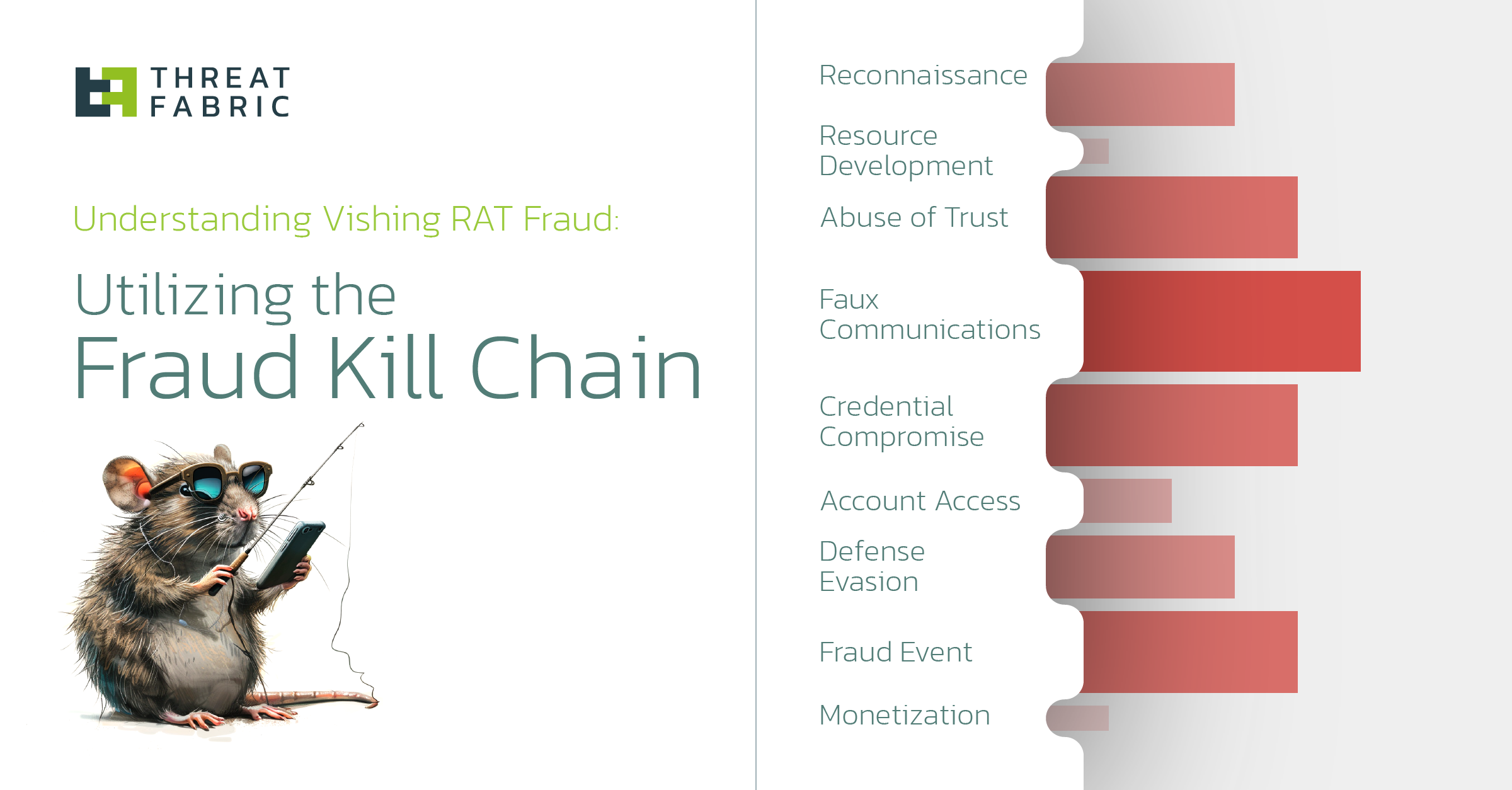

All modern fraud risks are covered, including the sophisticated hybrid fraud.

Account Takeover Fraud

Device Takeover (DTO) fraud

APP Fraud (Vishing)

Account Opening Fraud

Hybrid Fraud

Visibility

Frictionless, omni-channel detection layers based on many indicators.

Device Risk

Behavioral Risk

Identity Risk

Threat Intel

More

Value

Keep peace of mind and minimize fraud losses for you and your customers.

Real-time fraud visibility & alerts

Highly accurate risk indicators

Enrich Identity Proofing

Analysis Portal & Reporting

Managed Service

ThreatFabric's rating

Fraud Manager

Tier-1 bank

“We are having a great experience with the vendor and its product. They are flexible and always open to think with you about possible solutions. They frequently present us a roadmap on delivery and keep their promises on delivering.”

Fraud Lead

Tier-1 bank

"Great leadership and customer experience. It does not introduce any friction inside our SDK, easy integration and stable releases."

One step ahead

A proactive strategy to avoid a cat & mouse game

Keeping up with the latest sophisticated threats and attacks – or even being aware of them in the first place – is a reactive, lost battle where you will always be one step behind.

Instead, by focusing on what all fraudsters have in common, you will be able to protect your clients against all threats, including the unknown ones that develop their modus operandi over time.

This way you can truly stay one step ahead.

Why ThreatFabric?

Peace of mind for you and your customers

Proactiveness

Only by improving things today we can create a better world for tomorrow. We continuously try to optimize everything we do, regardless of who is or isn’t watching. We push for perfection, but never at the expense of progress.

Protection

We wear a white hat and are highly motivated to apply our unique knowledge mix of fraud, cybersecurity and banking malware to a good cause: to protect you and your customers.

Partners

Our customers will never love our work until we love it first. We feel honoured that we can collaborate with a talented international team, exciting customers and interesting partners to make the world a bit safer.